Vancouver, Canada – October 30, 2019 – GreenPower Motor Company Inc. (TSXV: GPV) (OTCQX: GPVRF) (“GreenPower” or the “Company”), a leading designer, manufacturer, and distributer of a range of all-electric buses, today announced results for its second quarter ended September 30, 2019.

Quarterly Highlights

- Generated quarterly revenue of $5.4 million, a record for the Company and more than double the first fiscal quarter’s of $2.4 million

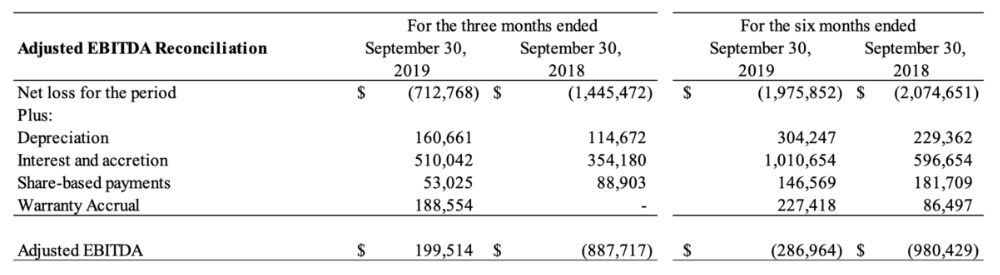

- Posted gross profit of $1.4 million and Adjusted EBITDA (defined below) of $0.2 million.

- Sold 27 all-electric buses during the period, comprised of 24 EV Stars, two Synapse Type D School buses and one EV 350.

- Delivered first two school buses to a school district in California, demonstrating GreenPower’s diverse range of all-electric vehicles.

- Delivered 20 EV Stars to Creative Bus Sales’ dealerships in California, Oregon, Washington, Texas, Arizona, Colorado, Indiana, Pennsylvania, and Georgia, expanding the Company’s presence nationwide. Creative Bus Sales is North America’s largest bus dealer for sales, parts and service.

- Engaged in on-site presentations and training for Creative Bus Sales staff from 17 of their 18 locations to enhance product knowledge and facilitate the sales process.

- Expanded the EV Star platform including EV Star, EV Star Plus and EV Star Cargo models with enhanced product flexibility and customization.

- Ended the quarter with 118 HVIP approved voucher requests for orders in California, for a total of $12.3 million reserved from 2019

allocation. - Finished the quarter with inventory of $6.9 million, including $2.6 million of finished goods and $4.3 million of work in process.

“I am excited to report the Company achieved several significant milestones this quarter, including record sales and deliveries along with positive Adjusted EBITDA,” said Fraser Atkinson, Chairman and CEO of GreenPower Motor Company. “Through execution of a comprehensive sales strategy and scaling of the business we are, as expected, producing improved financial results. Given our current strong order book and nation-wide sales reach, we are well positioned to continue to deliver robust growth going forward. We are pursuing various initiatives to maximize our operating efficiencies, expand margins, and leverage our position in the market to meet increasing demand across North America. We continue to work towards uplisting to the NASDAQ stock exchange, which, we believe, will be of benefit to our shareholders.”

Results for the Second Quarter Ended September 30, 2019

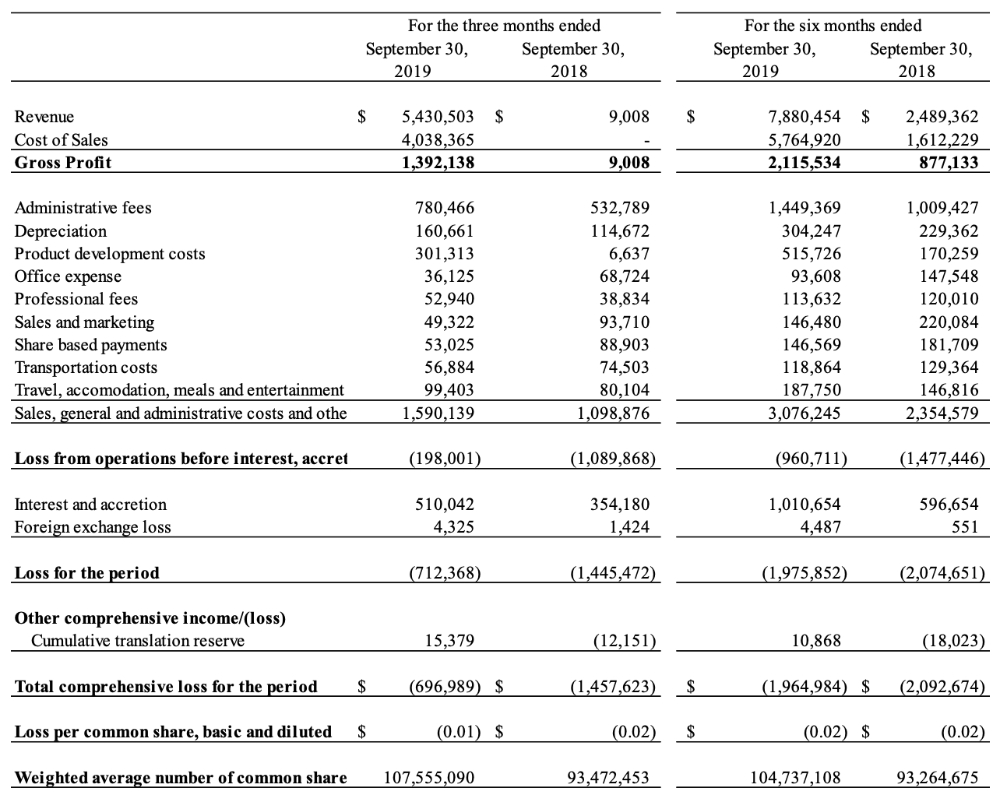

For the three-month period ended September 30, 2019, the Company reported revenue of $5.4 million and gross profit of $1.4 million, or 26% of revenue. Top line growth represented sales of one EV 350, two Synapse Type D school buses, and 24 EV Stars, as well as revenue from finance and operating leases and other sources. Selling, general, and administrative expenses (SG&A) were $1.6 million for the quarter, and the loss from operations before interest, accretion and foreign exchange was $0.2 million. The Company’s Adjusted EBITDA (defined below) was $0.2 million, and GreenPower reported a consolidated net loss for the quarter of $0.7 million, or $(0.01) per share.

Results for the Six Months Ended September 30, 2019

For the six-month period ended September 30, 2019, the Company reported revenue of $7.9 million and gross profit of $2.1 million, or 27% of revenue. The top line performance represented the sale of two EV 350s, two Synapse Type D school buses, and 27 EV Stars, as well as revenue from finance and operating leases and other sources. Selling, general, and administrative expenses (SG&A) were $3.1 million for the six months ended September 30, 2019, and the loss from operations before interest, accretion and foreign exchange was $1.0 million. The Company’s Adjusted EBITDA was $(0.3 million), and GreenPower reported a consolidated net loss for the period of $2.0 million, or $(0.02) per share.

Non IFRS Financial Measures

“Adjusted EBITDA” reflects net income before interest, taxes, share-based payments, depreciation and amortization, and warranty accrual. Adjusted EBITDA is a measure used by analysts and investors as an indicator of operating cash flow since it excludes the impact of movements in working capital items, non- cash charges and financing costs. Therefore, Adjusted EBITDA gives the investor information as to the cash generated from the operations of a business. However, Adjusted EBITDA is not a measure of financial performance under IFRS and should not be considered a substitute for other financial measures of performance. Adjusted EBITDA as calculated by GreenPower may not be comparable to Adjusted EBITDA as calculated and reported by other companies.

Conference Call

A conference call will be held on October 30, 2019, at 1:30 p.m. PT/4:30 p.m. ET and will be available for replay after complete. This call will contain forward-looking statements and other material information regarding the Company’s financial and operating results.

Participant dial-in: (US) 1-877-270-2148; (Canada) 1-866-605-3852; (international) 1-412-902-6510

Please ask to be joined into the GreenPower Motor Company Inc. conference call

Replay: (US) 1-877-344-7529; (Canada) 1-855-669-9658; (international) 1-412-317-0088

Replay access code: 10136658

Webcast link: https://services.choruscall.com/links/gpvrf191030.html

For further information contact

Fraser Atkinson

Chairman and CEO

(604) 220-8048

Michael Sieffert

CFO

(604) 563-4144

Brendan Riley

President

(510) 910-3377

GreenPower Investor Relations

Chris Witty

(646) 438-9385

About GreenPower Motor Company Inc.

GreenPower designs, builds and distributes a full suite of high-floor and low-floor vehicles, including transit buses, school buses, shuttles, a cargo van and a double decker. GreenPower employs a clean-sheet design to manufacture all-electric buses that are purpose built to be battery powered with zero emissions. GreenPower integrates global suppliers for key components, such as Siemens or TM4 for the drive motors, Knorr for the brakes, ZF for the axles and Parker for the dash and control systems. This OEM platform allows GreenPower to meet the specifications of various operators while providing standard parts for ease of maintenance and accessibility for warranty requirements. For further information go to www.greenpowermotor.com.

Forward-Looking Statements

This document contains forward-looking statements relating to, among other things, GreenPower’s business and operations and the environment in which it operates, which are based on GreenPower’s operations, estimates, forecasts and projections. Forward-looking statements are not based on historical facts, but rather on current expectations and projections about future events, and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. Such forward-looking statements include, among other things that the Company is well positioned to continue to deliver robust growth going forward, that the Company will maximize operating efficiencies, expand margins and leverage its position in the market, that the Company will list its shares on NASDAQ and that such listing will be of great benefit to the Company’s shareholders, that the Company will receive approval for its 118 HVIP voucher request worth $12.3 million. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others: the risk that government policies or laws may change and that additional governmental regulations may be implemented regarding the production and sale of electric vehicles; the risk that purchasers may not purchase the Company’s EV products; the risk that there may be additional competitors selling EV products; the risk that the Company will not be able to deliver completed buses on time; the risk that the Company’s clients will not default on their purchase terms; the risk that governmental regulations and taxation will change to adversely affect the Company’s business and financial results; the risk that government grants that reduce the cost of purchasing electric vehicles will be reduced, cancelled, or delayed, including the HVIP voucher requests relating to sales in California; the risk that the Company has a limited number of suppliers; the potential for supply-chain interruption due to factors beyond the Company’s control; the risk that there may be a recall of products; the inherent uncertainties associated with operating as an early-stage company; the Company’s ability to raise the additional funding that it will need to continue to pursue its business, planned capital expansion and sales activity; general economic conditions in Canada, the United States, China and globally; transportation industry conditions; potential delays or changes in plans with respect to deployment of services or capital expenditures; availability of sufficient financial resources to pay for the development and costs of the Company’s products; competition for, among other things, capital and skilled personnel; changes in economic and market conditions that could lead to reduced spending on green energy initiatives; competition in our target markets; management of future growth and expansion; the development, implementation and execution of the Company’s strategic vision; risk of third-party claims of infringement; legal and/or regulatory risks relating to the Company’s business and strategic acquisitions; protection of proprietary information; the success of the Company’s brand development efforts; risks associated with strategic alliances; reliance on distribution channels; product concentration; the Company’s ability to hire and retain qualified employees and key management personnel. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by applicable law, including the securities laws of the United States and Canada. Although the Company believes that any beliefs, plans, expectations and intentions contained in this news release are reasonable, there can be no assurance that any such beliefs, plans, expectations or intentions will prove to be accurate. Readers should consult all of the information set forth herein and should also refer to the risk factors disclosure outlined in the reports and other documents the Company files on SEDAR, available at www.sedar.com.

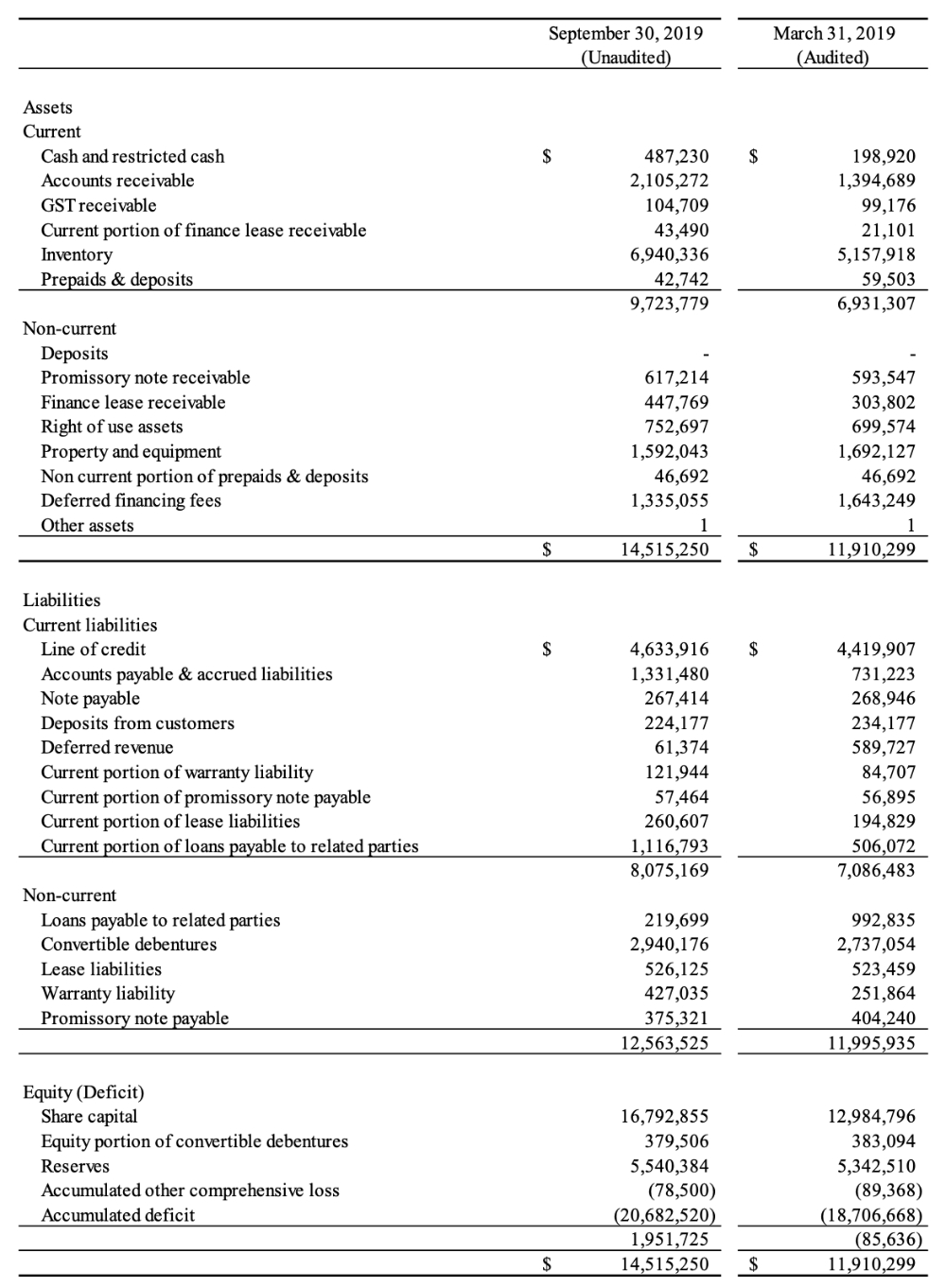

GREENPOWER MOTOR COMPANY INC.

Consolidated Condensed Interim Statements of Financial Position

As at September 30, 2019 and March 31, 2019

(Expressed in US Dollars)

(Unaudited – Prepared by Management)

GREENPOWER MOTOR COMPANY INC.

Consolidated Condensed Interim Statements of Operations and Comprehensive Loss

For the Three and Six Month Ended September 30, 2019 and 2018

(Expressed in US Dollars)

(Unaudited – Prepared by Management)

Please refer to GreenPower’s Consolidated Condensed Interim Financial Statements and accompanying notes and Management Discussion and Analysis for the periods ended September 30, 2019 and September 30, 2018 as filed on SEDAR (https://sedar.com/).